Big changes to American Express Platinum on the way, including a metal card and higher fee

Links on Head for Points may support the site by paying a commission. See here for all partner links.

American Express is planning yet more changes to its UK card portfolio, this time on The Platinum Card. For once, you are getting four weeks notice of what is going to happen.

Whether you are a cardholder or just a potential cardholder, you have time to make your plans accordingly.

Here is the news in a nutshell:

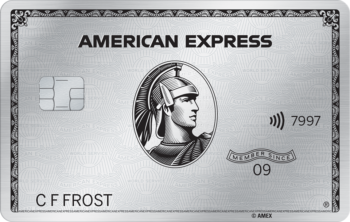

The Platinum Card will be made from metal, not plastic – see the image below

The annual fee increases from £450 to £575, albeit with some modest improvements in benefits

The spend required to earn the 30,000 points sign-up bonus is doubling

The new fee and benefits come into effect from 11th June for new cardholders. Existing cardholders will receive the new benefits from 11th June and will be charged the higher fee on their next renewal after 1st August.

Let’s look at the new package in detail:

A new Platinum card, made from metal

American Express launched a metal version of The Platinum Card in the US in 2017 and has been slowly rolling it out since. Arguably they have missed the boat in the UK, since Curve, N26 (N26 Metal reviewed here) and Revolut (Revolut Metal reviewed here) have all launched in the last six months.

I have been using a metal Curve card for a few months. They are surprisingly heavy and fall out of your wallet easily. The good news is that I have never had a problem using it in a card terminal or ATM.

New cardholders from 11th June will receive a metal card automatically. Existing cardholders will receive one when their current card expires. If that is a long way away, I imagine that if you call after 11th June to say that you have lost your card, the replacement may well be metal …..

Platinum supplementary cards will also be issued in metal.

Looking at the image above, I image that – like Curve – your name, card number and expiry date will be printed on the back of the card to make the front look more stylish.

An increased fee, from £450 to £575

Existing cardholders will be billed £575 from their next renewal after 1st August. New cardholders will pay £575 from 11th June.

If you apply before 11th June you will pay the existing £450 for the first year.

Additional Platinum supplementary cards go up from £170 to £285

Additional Platinum supplementary cards after the first free one will be charged at £285 instead of £170.

Whilst this is a sharp jump, the current £170 fee for additional Platinum supplementary cards is ludicrously cheap. You can basically give someone full Priority Pass membership (admits two), Hilton Honors Gold, Marriott Bonvoy Gold, Radisson Rewards Gold, Shangri-La Golden Circle Jade, Melia Rewards Gold, Eurostar lounge access, full travel insurance etc for £170 per year. It is exceptional value and couldn’t last.

Additional supplementary cards issued as Gold cards will continue to be free but will continue to not have any benefits except for being covered by The Platinum Card travel insurance.

A sharp jump in the spend needed to trigger the sign-up bonus

The sign-up bonus on The Platinum Card is a generous 30,000 Membership Rewards points. This converts into 30,000 Avios or various other airline and hotel schemes. Airline transfer rates are 1:1. The hotel transfer rates are 1:2 into Hilton, 2:3 into Marriott and 1:3 into Radisson. You can also convert at 15:1 into Club Eurostar. You can see the partner list on the Membership Rewards site here.

From 11th June, new applicants will need to spend £4,000 within three months to trigger the sign-up bonus. This is a sharp increase on the current £2,000. You should apply before 11th June if £4,000 would be a stretch.

£10 per month of Addison Lee credit

Cardholders will receive £10 cashback per month on Addison Lee taxi rides charged to their card. This does not accumulate if unused in any particular month.

If you use this, you will save £120 per year which offsets the fee increase. This is fairly easy if you live in London but far more difficult if you don’t.

This benefit is only available to the primary cardholder and not to the Platinum supplementary cardholder. The annual benefit is therefore capped at £120.

$200 credit on EVERY onefinestay house rental

This is potentially very interesting. You will get $200 cashback each time you spend $200 or local currency equivalent on The Platinum Card on a onefinestay house or apartment rental.

(Rentals in the UK receive £150 cashback on stays of £150+. Rentals in the Eurozone receive €170 cashback on stays on €170+.)

I thought this would come with a catch, but it doesn’t. I have spoken to Amex and you will get the cashback on each and every booking. The nearest thing to a ‘gotcha’ is that you must opt-in to this benefit via the American Express website when it goes live on 11th June. If you forget to opt in, you won’t receive your cashback.

The only snag is with onefinestay itself. Most of their houses require a three night minimum stays – not all of them, but most. Looking at a low cost country such as Thailand, the cheapest place I could find is $185 per night in Koh Samui with a three night minimum. The cheapest with a two night minimum is $450 per night – although you are, of course, getting a monumentally large Koh Samui villa for this! If you think that you will be able to book yourself a cheap $200 property and essentially pay nothing due to the $200 cashback, you will be disappointed.

Other new benefits that I won’t insult your intelligence with by pretending they are useful

You will be able to book American Express restaurant partners via the Amex app instead of calling (some of these deals are OK, to be fair, and offer benefits such as a free glass of champagne to cardholders)

You will be able to message American Express from inside the Amex app

You will be able to use the American Express Centurion Lounge in Heathrow Terminal 3 when it opens later this year (I have no doubt that this will be an excellent lounge – Centurion Lounges have a great reputation – but Platinum cardholders would have got access anyway and there are already two good Priority Pass lounges in Terminal 3. There is nothing new about this.)

Conclusion

For existing Platinum cardholders, the key question is whether you can easily use the monthly Addison Lee credit.

If you will, the increase in annual fee is offset and you are in a similar position to where you are today. If you can’t use the Addison Lee credit, you are facing a £125 fee increase with very little in return, unless you become a heavy onefinestay user.

For potential new Platinum cardholders, the increase in target spend to £4,000 within three months to trigger the sign-up bonus could be a deal-breaker. I strongly recommend applying before 11th June to lock in the existing £2,000 spending target if you can. You can apply here – note that the website will not be updated with the new details until 11th June.

As a reminder, you qualify for the 30,000 Membership Rewards points sign-up bonus if you have not had any card which earns Membership Rewards points – ie Gold, Green, Platinum, Centurion or the Amex Rewards Credit Card – in the past 24 months.

In general, you need to look at The Platinum Card like an iPhone. You could, in theory, save a lot of money by scrapping your iPhone and buying a torch, alarm clock, Chromebook, portable hi-fi, calculator, stopwatch and a non-smartphone separately. Most people don’t.

Similarly, you could drop your Platinum card and:

pay for travel insurance for your entire family and the families of five random people you would otherwise give a supplementary card

pay for car hire insurance when you rent (although insurance4carhire will sell you an annual policy cheaply)

pay for airport lounge access, potentially via a Priority Pass (or buy pricier tickets which include it)

pay more for luxury hotels rather than using Fine Hotels & Resorts (admittedly you can book many FHR properties with similar benefits via our hotel partner Bon Vivant)

pay more for Eurostar tickets to get lounge access via your ticket type

pay for better quality rooms and breakfast at Hilton, Marriott, Radisson, Melia and Shangri-La hotels instead of relying on your status benefits

pay for an ice scraper for your car rather than using the new metal Platinum card

etc etc. You need to do the maths based on your own personal circumstances.

Should I apply for The Platinum Card NOW to lock in the £2,000 bonus spend target and the £450 fee?

Probably. You will get a better deal than usual, because you will only pay £450 but will earn 11 x £10 Addison Lee credits before your first renewal at the higher rate.

Wait until tomorrow, however, when I will run a full article on what The Platinum Card gets you.

The Platinum Card website is here if you want to apply or find out more, although the benefits I describe above will not be shown until 11th June.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 65,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – April 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 27th May 2025, the sign-up bonus on the ‘free for a year’ American Express Preferred Rewards Gold card is increased from 20,000 Membership Rewards points to 30,000 points. Points convert 1:1 into Avios (30,000 Avios!) and many other programmes. Some people may see even higher personalised offers. Click here to apply.

SPECIAL OFFER: Until 27th May 2025, the sign-up bonus on American Express Platinum is increased from 50,000 Membership Rewards points to a huge 80,000 points. Points convert 1:1 into Avios (80,000 Avios!) and many other programmes. Some people may see even higher personalised offers. Click here to apply.

American Express Preferred Rewards Gold

Your best beginner’s card – 30,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus

30,000 Avios and the famous annual 2-4-1 voucher Read our full review

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

American Express Business Platinum

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 1 Avios per £1 Read our full review

British Airways American Express Accelerating Business

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (665)